Metals trading

TRADE PRECIOUS METALS SUCH AS GOLD AND SILVER WITH FAST EXECUTION, LOW-COST PRICING MODELS AND FLEXIBLE LEVERAGE OPTIONS. PRECIOUS METALS PROVIDE A USEFUL AVENUE FOR TRADING STRATEGY DIVERSIFICATION AND ARE CONSIDERED AS SAFE HAVENS DURING TIMES OF MARKET TURMOIL.

What are the advantages of trading Metals with nexapip?

Real-time Gold Charts

Leverage up to 1000:1

Trade 24 hours a day, 5 days a week

NexaPIP Platform on desktop and mobile

Hedge risk & expand your portfolio

Low cost trading

DIVERSIFY YOUR PORTFOLIO

What is Metals trading?

Precious Metals are rare, naturally occurring metallic elements with high economic value. They are unusual in that they are both industrial elements and investments. Manufacturers use these metals to make electronic components, jewelry, dental equipment and catalytic converters among other things. Investors, on the other hand, collect coins and bars made out of precious metals.

This second use – as investments – makes precious metals the objects of intense speculation in commodity markets. Precious metals traders see these commodities as a form of money that holds its value better than printed paper money. Skeptics, however, argue that precious metals are simply rocks with little utility beyond their limited industrial uses. Ironically, the high premium placed on precious metals by traders makes them too expensive and impractical for most industrial applications.

HOW TO TRADE GOLD

How does Metals trading work?

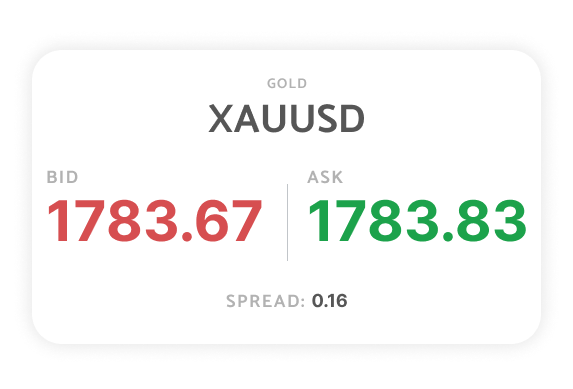

Trading a contract for difference (CFD) on gold is similar to trading currencies. You are buying or selling a gold CFD in response to price movements in the market. Trading gold allows you to enter and exit trades without ever physically owning this precious metal. The concept is very similar to forex trading. Gold is traded against the US dollar and the symbol is XAUUSD. If you decide to add precious metals to your portfolio you can trade it as you would a currency pair. If you believe the gold price will fall, you can sell the “pair”, and when you think the gold price will rise, you can buy it.

For example, XAUUSD shows us that 1 ounce of Gold = $1895.24 USD.

When you’re ready to trade you will choose to go long or short. In the example above, going long means that you think that the value of Gold will rise against the US Dollar. Going short means you think it will fall.

A Beginner’s Guide to Precious Metals

The limited supply of precious metals and characteristics including resistance to corrosion make them highly valuable. The soft texture and shiny appearance of precious metals allows for a range of applications including jewellery, industrial uses and dentistry. Gold, silver, platinum and palladium are the most traded precious metals.

Benefits of Trading Metals

Aside from being rare and valuable, there are numerous benefits associated with trading precious metals. Historically, during economic slumps and periods of market uncertainty the value of precious metals has risen. Consequently, metals are considered a safe-haven investment and are often used as part of a risk management strategy. Metals are used as a hedging tool against inflation and fluctuations in currency prices. It is very common for traders and investors to diversify their portfolio by allocating a percentage of it to precious metals.

Start trading with NEXAPIP on spreads from 0.2 pips

METAL CFDS

How Can I Invest in or Trade Precious Metals?

Investing or trading precious metals does not have to mean holding a gold bar or coin. With metal CFDs you no longer need to own and possess the actual precious metal. Through Contracts For Difference (CFDs) you can gain exposure to precious metal prices that are comparable to the largest metals exchanges in the world. The benefits of CFDs include leveraged trading and the ability to open both long positions and short positions. Metal CFDs eliminate the risk of theft and have no storage costs as you do not own the underlying asset. Exchange-traded funds (ETFs) are another way to invest in precious metals and commodities in general.

METAL CFDS

Factors Affecting Precious Metal Prices

The factors that influence precious metals include but are not limited to:

Supply and Demand

Like all products and services, the laws of supply and demand also apply to precious metals. A shortage, surge in need or interruption in production will result in an increase in metals prices. Conversely, faster extraction through technological improvement or other factors could saturate the market and diminish their value.

Economic Instability

Market conditions including currency prices have a direct impact on metal prices. Precious metals are traditionally negatively correlated with the US dollar making them a useful hedging tool in times of economic instability. The same applies during political uncertainty and unexpected global events.

Regulation and Economic Decisions

nything that dilutes the value of a currency results in an increase in precious metal prices. This is the case with quantitative easing (printing additional money) and higher rates of inflation. As metals are considered an alternate investment to the cash rate provided by financial institutions, their value generally decreases when interest rates rise.

Industrial Output

The continual increase in industrial uses will have a positive impact on metal prices. Precious metals are being used in high performance applications such as electronics, energy and automotive related products. An increase of demand in these products and new applications will increase demand and precious metal prices.

Are Precious Metals a Good Investment?

Precious metals are a unique asset class as they have intrinsic value, provide protection against inflation and carry a safe-haven status. When utilised to diversify a portfolio, precious metals will reduce both volatility and risk.

Trade Precious Metals With a Provider Invested in Your Success

Open a Nexapip trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with Nexapip.

TRADE WITH

Gold trading example

The gross profit on your trade is calculated as follows

OPENING PRICE

$1,899.55 × 1 lot (100 ounces)= $189,955

CLOSING PRICE AT

$1902.05 × 1 lot = $190,205

GROSS PROFIT ON LONG POSITION

$190,205 – $189,955 = $250

CLOSING PRICE AT

$1,897.05 × 1 lot = $189,705

GROSS LOSS ON SHORT POSITION

$189,705 – $189,955 = -$250

Opening the position

The price of Gold against USD (XAUUSD) is $1,899.55 and you decide to buy 1 lot. The total value was $189955 USD.

Closing the position

Two weeks later, if the price of Gold against USD (XAUUSD) is $1,902.05 and you decide to take your profit by selling 1 lot XAUUSD, the total value is $190205 and the gross profit is $250; if the price of XAUUSD has fallen to $1,897.05 and the total value is $189705 the trade loses $250

TRADE FROM 0.0 PIPS

Typical Metals spreads

| Primary Account | Advance Account | |||||

|---|---|---|---|---|---|---|

| SYMBOL | PRODUCT DESCRIPTION | AVAILIBILITY | MIN | AVG | MIN | AVG |

| XAUUSD | Gold vs Us Dollar | NexaPIP Platform | 0.16 | 0.23 | 0 | 0.09 |

| XAUEUR | Gold vs Euro | NexaPIP Platform | 0.14 | 0.49 | 0.18 | 0.31 |

| XAGUSD | Silver vs Us Dollar | NexaPIP Platform | 0.14 | 0.03 | 0 | 0.02 |

| XAGEUR | Silver vs Euro | NexaPIP Platform | 0.02 | 0.03 | 0.02 | 0.02 |

| XAUAUD | Gold vs Australian Dollar | NexaPIP Platform | 0.21 | 0.73 | 0.33 | 0.57 |

| XAGAUD | Silver vs Australian Dollar | NexaPIP Platform | 0.41 | 0.04 | 0.01 | 0.03 |

TRADE WITH CONFIDENCE

Trade With a Provider Invested in Your Success

Open a Nexapip trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with Nexapip.

24/5 Customer Support

Our dedicated team of customer support agents are on hand 24/5 to provide you with multilingual support. Contact Us

Any questions?

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions.

Follow us for Market Analysis

Stay on top of market trends and analysis by following us on social media and visiting our financial markets blog. Blog